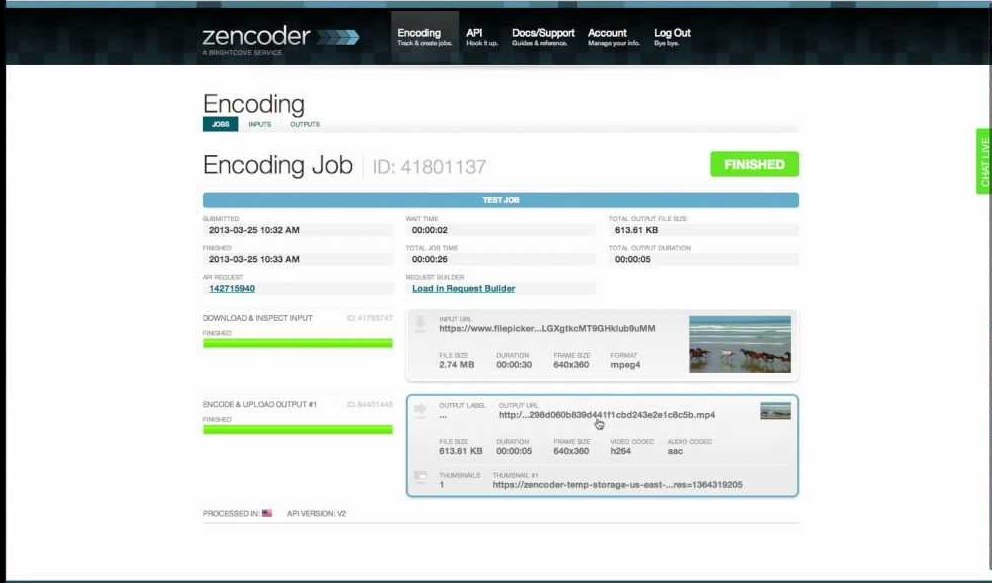

Beginning in January 2008, Zencoder.tv, an American video encoding and transcoding software opened the domain. The function of the site was to offer reliable and customer-specific video transcoding software at a good price. Software operation The operation of the software…

History of the djia.tv website

The djia.tv website was a video-based blog that started running in 2006 providing its readers with the latest news on the stock market, as well as on financial and general issues. The website focused on a few main investors of the…

Temporary Worker Visa to USA

The Temporary Worker Visa to the United States is an entry permit for all foreign visitors that plan to visit this country for work. However, the period of working is not unlimited. It serves only temporary employment in the US.…

US Crewmember Visa

The US Crewmember Visa is a nonimmigrant entry permit designed for anyone working on the United States commercial sea ship or the US international airlines. The applicants must be delivering services needed for regular operation. Another requirement to meet is…

US Visa Waiver Program

The United States Visa Waiver Program (VWP) was designed to facilitate entering the US for citizens from 39 eligible countries. Nationals of VWP countries can now cross the United States border with an electronic ESTA permit. ESTA stands for the…

US Exchange Visitor Visa

The United States Exchange Visitor Visa is a nonimmigrant entry permit to the US that is dedicated to foreign: researchers, students, trainees, scholars, interns, and specialists. The requirements, length of the permitted stay, and usage differs depending on which type…

US Visitor Visa

US visitor visa is one of the best known types of entry permits when it comes to traveling to the United States. It is a regular visa that requires applicants to visit the Embassy and undergo an interview with a…

USA Visa Types

The United States government offers numerous different types of visas for all foreign nationals planning to visit the US. However, to make things more simple, we can divide all of them into three groups. The first group of US visas…

ESTA for the USA for Czech citizens

As many European, Czech citizens love to travel. Traveling to the other continents is an amazing adventure. How about the United States? Now from this journey divides you only a few minutes. Before, to visit the USA, a regular visa…

ESTA for the USA for Taiwanese citizens

Traveling and meeting new cultures was always inscribed in human nature. Visiting the US is for sure the best way to explore part of the world in this way. This big land is inhabited by many nations, which live together…